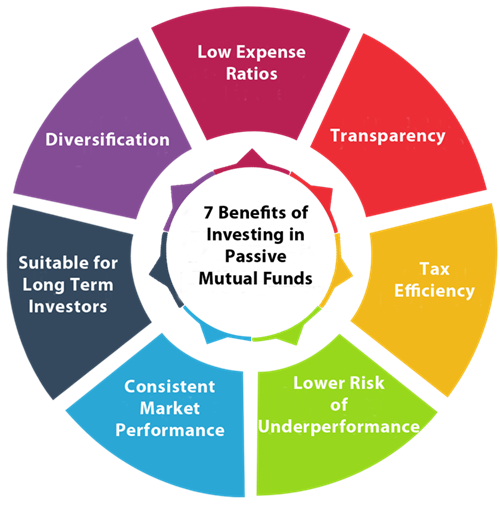

Passive mutual funds have been gaining popularity in India due to their unique features and advantages. Here are the 7 top benefits of investing in passive mutual funds in the Indian context:

1. Lower Expense Ratios

– Benefit: Passive mutual funds typically have lower expense ratios compared to actively managed funds. This is because they track an index (like Nifty 50 or Sensex) and don’t require active research or frequent portfolio changes.

– Why it matters: Lower costs mean more of your money is working for you, helping to increase your returns over time.

2. Transparency

– Benefit: Since passive mutual funds track a specific index, their holdings are known in advance. This means you can easily see which stocks or sectors the fund is invested in.

– Why it matters: The transparency of passive funds gives investors more clarity and helps them feel more in control of their investments.

3. Consistent Market Performance

– Benefit: Passive funds aim to match the performance of the underlying index, which typically offers steady returns in line with overall market growth.

– Why it matters: For long-term investors, this approach can provide a consistent and reliable performance that closely mirrors the market, which has historically trended upwards over time.

4. Diversification

– Benefit: By investing in an index like Nifty 50, a passive mutual fund provides automatic exposure to a wide range of companies across sectors.

– Why it matters: Diversification helps reduce the risk associated with individual stocks. It allows investors to spread their investments across multiple industries, ensuring that poor performance in one stock doesn’t significantly hurt the overall portfolio.

5. Lower Risk of Underperformance

– Benefit: Active funds often fail to outperform their benchmark indices over the long term, especially after factoring in higher fees. Passive funds, by design, match the performance of the index they track.

– Why it matters: This reduces the risk of underperformance, which is common in actively managed funds that rely on fund managers’ decisions. Passive funds ensure you get the market’s average returns, which have historically been strong.

6. Suitable for Long-Term Investors

– Benefit: Passive mutual funds work well for long-term investors who are less focused on short-term market fluctuations. Since the objective is to match the market performance, they are ideal for building wealth over time.

– Why it matters: Given that markets generally grow in the long run, passive funds allow investors to stay invested without worrying about short-term market movements.

7. Tax Efficiency

– Benefit: Passive mutual funds often have a lower turnover rate than actively managed funds, leading to fewer capital gains distributions.

– Why it matters: This lower turnover helps minimize the tax liabilities (like Short-Term Capital Gains Tax and Long-Term Capital Gains Tax) on any realized profits, especially if you hold the fund for the long term.

Summary of Benefits:

1. Lower Expense Ratios – More cost-effective

2. Transparency – Clear visibility of the fund’s holdings

3. Consistent Market Performance – Matches the index performance

4. Diversification – Broad exposure to various sectors

5. Lower Risk of Underperformance – Less chance of lagging behind the market

6. Suitable for Long-Term Investors – Ideal for those focusing on long-term wealth building

7. Tax Efficiency – Potentially lower taxes due to lower turnover

Disclaimer: Mutual Fund investments are subject to market risks. Read all the scheme related documents carefully before investing.

Leave a Reply